We now enter week two of the latest Israeli-Iranian exchanges. There’s no doubting it has been severe. For perspective, the Iranian strike rate is close to 10% from its array of missiles and rockets fired that have penetrated Israel’s defences.

Iran’s strategy is not aimed at destroying Israel – but rather to raise the cost of continued air strikes sufficiently to force a pause or negotiation while safeguarding its strategic deterrent…..and this pause has been concerning enough to galvanise Israel into escalating action to the next level.

What is the next level?

There are two: (1) neutralise Iran’s enrichment capability and (2) if possible, instigate regime change. Throughout all of this, markets remain alarmingly complacent suggesting they do not see any major risk and, at the very least, they see things remaining contained!

Some key factors to consider:

1, Fordow is built 80 to 100 metres underground into a mountain. It has already reached uranium (U-235) enrichment capability of 60%. It is heavily guarded.

2. Israel’s “bunker buster” bombs (GBU-28) are not up to the job. They can only penetrate some 6 to 8 metres. Furthermore, air-launched cruise missiles – though accurate – are not powerful enough.

3. All of which means the US would have to assist because they have the GBU-57A/B bombs capable of destroying hardened bunkers like Fordow.

4. Even then, it is questionable whether Fordow can be rendered entirely ineffective from the air – which then begs the question, do we see “boots on the ground”? This is Trump’s dilemma – even his own MAGA support base is highly divided over this. What they think matters to Trump!

5. So, why did Trump announce a two-week timeline to decide on whether to join Israel in a strike on Iran? Officially because “there is a substantial chance of negotiations that may or may not take place with Iran in the near future” (quote from Karoline Leavitt in her press briefing).

The reality, however, is any strike on Fordow requires meticulous, military planning. That said, rumours suggest an attack could even come this weekend. What Trump does next will define his Presidency and set a precedent for others who are watching closely (e.g. China’s intentions over Taiwan).

6. Russia has limited itself to strong verbal support for Iran. Besides condemning attacks on the Bushehr nuclear plant (which was built and staffed by Russians), Russia has lost its mojo for any military involvement given its own deteriorating position in Ukraine.

As for China it too condemned Israeli strikes and called for de-escalation. While it has been boosting diplomatic and economic relations with Iran, there is no formal alliance between the two and, beyond this, China doesn’t want to get involved militarily. It even stopped selling sophisticated equipment (e.g. jets and air defence systems) to Iran since 2005.

The main risk to China is that a collapse in the Iranian regime would be a blow to its BRI (Belts and Road Initiative) and compromise the security of the “China-Pakistan Economic Corridor” potentially providing the US a back-door route into the region. It seems China is prepared to live with that risk. It would prefer to see the US get tied up into another Middle-East crisis….that opens the door for its own strategy re Taiwan.

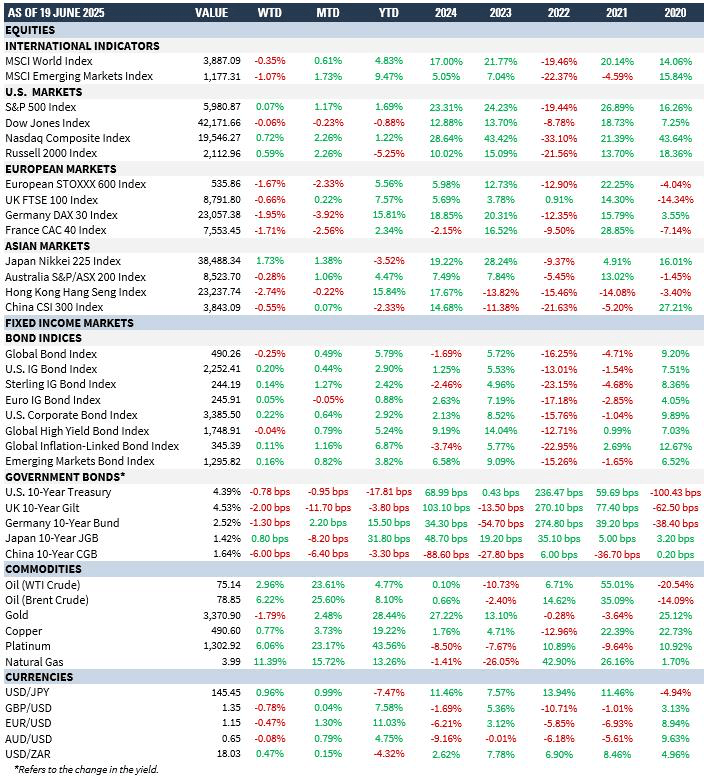

Overall, markets have been in a hold formation as a result of the above events – not just since last Friday but since the start of the missile attacks. Oil prices are +23% to +24% month-to-date. This has pass-through implications for inflation which itself has generally been coming down as per recent inflation prints (except Japan). To give you an idea:

- The Direct Impact of inflation feeds into gasoline and heating oil prices. Energy combined is around 7% to 9% of US CPI. It is even more in the Emerging Market world though somewhat less in Japan and EU due to subsidies. As an approximate rule of thumb, every +$10 rise in WTI oil equates to about a +0.2% to +0.3% increase in headline inflation over just a few months. With WTI up $10 just over this past week, that’s impactful.

- The Indirect Impact is on via supply chains and affects transportation costs (e.g. trucking, aviation, shipping), plastic-based products (packaging, materials) and agriculture (fuel and fertilisers). The effects of these have a secondary knock-on and are smaller ranging from +0.05% to +0.10% but tend to be stickier if oil remains elevated for several months. Think back to Russia’s invasion of Ukraine.

The impact of this varies country-by-country and is a function of the following:

- Inflation is amplified if your currency weakens, you have a high reliance on energy, still suffer from a tight labour market and of course if higher oil prices remain prolonged.

- It is dampened for largely the opposite reasons to the above – additionally if a country offers subsidies/fixed fuel prices and you have falling consumer demand. Subsidies are a cost and have a net fiscal impact. Falling consumer demand implies sliding growth.

- The impact on inflation tends to be quick (2 to 3 months): for the US around +0.2% to +0.3%, the Eurozone about +0.15% to +0.25% (helped by energy tax concessions, the UK is very sensitive to oil prices and is similar to the US in that regard while for Japan its minimal due to subsidies. However, worryingly, today’s core inflation print in Japan came in higher than expected and above expectations to settle at between 3.3% to 3.7% pa. This is closely watched by the BoJ.

These estimated increases are not massive but they feedthrough into bond yields and raise debt-servicing burdens while constraining growth. We’ve just had the passing of the “One Big Beautiful Bill” Act in the US which adds almost $3tn over the next 10 years ($300bn pa).

Part of this is mitigated through tariff revenues of about $100bn to $200bn pa – but still leaves a bigger net hole to be filled…….at a time when GDP projections are being cut between 0.4% to 0.8% pa. We need this new round of geopolitical risk to dissipate quickly (and not be followed any time soon by a new one such as the South China Seas) to drive down risk premia.

MARKET SUMMARY…