On 16th September, the Senate confirmed Stephen Miran as a new Fed board member. In his confirmation hearing, he reminded people the Fed mandate includes “moderate, long-term interest rates”.

He also spoke (to CNBC) for the need to cut rates -0.50% and that this should have been done the week before when they were cut -0.25%. He also argued it should be followed up with two more rate cuts of -0.50% in each of the next two FOMC meetings saying a “neutral” rate is now the proper setting for an economy that has no inflation risk and will see lower housing costs as immigration policies soften demand! He stated “I don’t see any significant tariff inflation. I see disinflation coming from border policies. I don’t see a reason for being so far from neutral at the moment….. The longer you stay very restrictive, the greater the risks of significant misses to the employment mandate”.

Most recently, (23rd) he said: “the Fed is misreading how tight monetary policy is and, in doing so, is putting the jobs market at risk….The Central Bank has failed to grasp how the Administration’s immigration, tax and regulatory changes are reshaping the economy and likely driving down the so-called neutral rate of interest”. He even went as far as putting a figure on how far the Fed should cut…..2% as part of a rapid, easing move! Other Fed members are not in agreement – Musalem and Bostic to name two. Both remain concerned inflation is in the system though Bostic did say he was surprised tariffs have not come through citing it is a matter of time. Whether you agree/disagree with new Fed Governor Miran, it’s clear where the shape of the new Fed is headed post life after Powell (31st January, 2026). Trump is changing the balance and internal debates, from here, will be fast & furious.

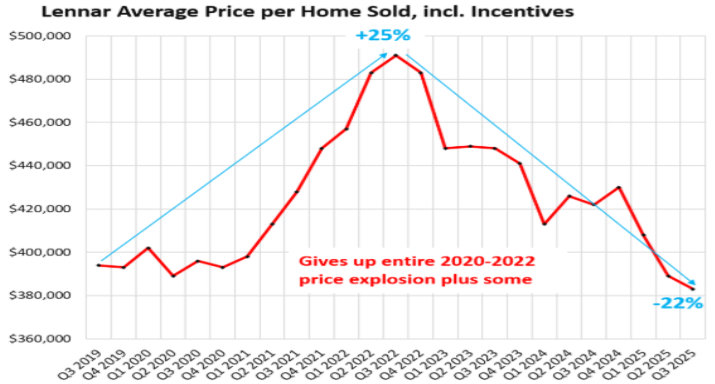

Speaking of “greater risks of significant misses”, President Trump aptly renewed his calls for aggressive monetary easing…..this time citing the housing market. PIMCO came out with a statement arguing that in order to boost the housing market, the Fed should consider halting further shrinking of its mortgage holdings as part of the current QT (Quantitative Tightening) programme.

30y fixed rate Mortgages are yielding 6.39% vs 10y Treasuries yielding 4.16%. The spread (former minus the latter, a measure of risk) remains “unusually wide”. If instead the Fed was to reinvest maturing mortgages (principal & interest) rather than redeem (buy back) them, it would help cut that spread (i.e. lower risk) and so help lower mortgage rates.

Trump’s comments were timely – and ahead of results published by homebuilder, Lennar. Its revenues were down -8.8% y/y – primarily because of incentives, given to drive sales, jump +14.3% y/y. This reduced its gross margins to 17.5%, previously 22.5% a year earlier. Its operating earnings from homebuilding fell -49%, its net income -50% and its EPS (Earnings Per Share) -46%. Its average selling price (per home sold, including incentives) is down -22% since Q3 2022 (see chart below). Contrast that with a rise of +25% three years before (Q3 2019).

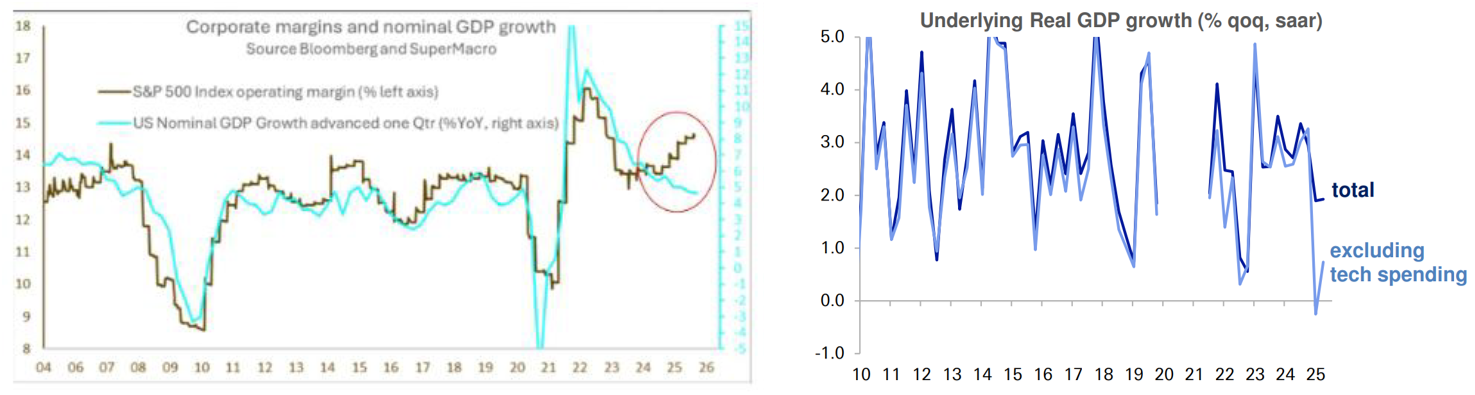

There’s another consideration to bear in mind. With the economy deemed to be slowing, there is a growing divergence between nominal GDP growth and S&P operating margins. The chart below (by Zero Hedge) highlights the potential disappointment that lies ahead for investors in the months to come given the clear divergence between the two. The US 2y Treasury yield has fallen sharply suggesting the Fed is increasingly behind the curve (the effective Fed Funds Rate is currently 4.09% while the US 2y Treasury rate is at 3.66%, a spread in excess of 0.55%. The 10-year yield has also fallen to 4.16% – reflecting anticipated, slower nominal growth ahead. Something has to give – equity markets keep rising, valuations are becoming stretched. The ”E” in “P/E” is not rising as strongly as the “P”. A DB study shows that, without Tech, the US economy would have been close to – if not in – recession this year. It goes on to make a key point: huge CAPEX (Capital Expenditure) spend could help explain why weak payrolls are not hurting growth – as well as global trade remaining resilient (buying and selling of chips). So, as long as this CAPEX trend continues (note Nvidia’s announcement of US$100bn in data centres), the tech theme remains well-buoyed into next year.

So what should we make of the road ahead? In the short-term, it is an interest rate story:

- Is the economy fundamentally slowing – or was the recent slowdown due to caution around tariffs & geopolitics? Thursday (25th) saw the release of the final US Q2 GDP print: it was revised upwards by +0.5% to 3.8% q/q. In particular, there was a +0.9% upward revision to consumption growth to 2.5% q/q; real domestic final sales was revised up +0.8% to 2.4%; private fixed investment was revised up from +0.4% originally to 4.4% with double-digit upward revisions to sub-components. There were downward revisions to net exports, government consumption and inventories but these will likely be a boost for Q3/Q4 e.g. inventories as stores start to stock up especially ahead of Christmas. I think Fed Chair Powell will have taken a good at this data and will be feeling vindicated – it points to underlying, inflationary strength which is exactly what the Fed has been deliberating.

- We have the beginnings of a synchronised, rate cutting cycle taking place across some major economies (US, UK, Europe, Canada). The search for the right neutral rate is turning into a political battle – as evidenced by the changing of the guard at the Fed. Come January next year, it’s going to be a different picture.

- For now inflation remains tame. It has risen but not in any meaningful way. Sharply lower rates (à mortgages), low energy prices, possibly a revision to QT (buying of mortgage-backed securities which are currently running at some US$18bn per month) and a lower impact from the shelter component of the inflation basket will be a boon to both consumers and equity markets. Yesterday’s Q2 GDP print also saw an upward revision to core inflation of +0.13% taking it to 2.60% annualised. The headline rate was revised up +0.12% to 2.13% y/y. So, while inflation remains “tame”, it seems to be leaning more to the upside than the downside – probably due to the persistent, underlying strengths in the economy mentioned in point 1.

- Tariffs have not spurred inflation as expected. Perhaps it’s a delayed reaction but MacroStrategy reported comments made by Howard Lutnick (US Commerce Secretary) who tried to explain what’s happening: he argues “foreign governments have been bearing the brunt of US tariffs over 15%, with China paying the lion’s share…..China is paying an average tariff of 52%…..but the government of China is eating most of it. So while that’s a high average when you count in China, the government of China is covering most of that cost…….most countries aren’t facing tariffs above 15% and that when they do, the foreign governments step in to keep their businesses afloat while they negotiate better terms…..The model is clear: 10% tariffs or less are paid by the manufacturers, the distributors, the businesses,……..the consumer doesn’t pay…..as the seller doesn’t want to raise prices because if they could, they would – but they don’t want to sell less. So they eat it…….If the duties are between 10 and 15%, the distributor and manufacturers share the cost at about a 60-40 split, resulting in about a 2 percent price increase with tariffs of 15%……And above 15%, no one can handle that … unless the government covers it. So what you saw in cars, when you had 25%, before Europe made their deal and Japan made their deal, the government of South Korea and Japan and Europe covered it, because they didn’t want to hurt their employment”

- In a note issued by GS, investment in AI is booming with revenues – at US companies (by far the largest component of the World Index) – having risen some US$400bn since 2022. However, the latter is distorted due to substantial frontloading earlier in the year as well as the re-exporting of imported goods. Adjusting for this, they estimate the “true” impact on US GDP to be about US$160bn since 2022 (= 0.3% annualised rate). However, the amount that has been captured is estimated to be only US$45bn (=0.1% annualised) because of the difference in methodology for estimating GDP. Some components of AI (such as cloud servicing) are not even measured at all.

- The big unknown is inflation! It’s the reason the Fed is divided. What Miran (the new appointment) highlights is that the Fed is gambling with the labour market. The original breakeven rate of job growth has clearly come down given the softer pace of the economy. Originally, economists were saying it was between 100,000 to 150,000 per month. The amount estimated to be required now is circa 70,000 per month. At the current pace, it has softened to as low as 25,000 per month – and this is the point Miran is making: that Fed policy is behind the curve and far to restrictive. However, bringing rates down (hard and fast) to a lower neutral rate (which is what he is arguing for) together with the points referenced above (no. 2), PLUS the benefits of the OBBB – the consumer gets quite an uplift. Think back to Trump’s first term in office – inflation was on the rise primarily due to consumer demand. It’s only after that Covid (supply-led inflation) set then to be followed by Russia’s attack on Ukraine (energy-led inflation). Both the latter two have more or less disappeared. We’re likely headed back to consumer demand-led inflation that will play out during 2026.

- Asset implications? For now, it’s largely the same drivers – Tech (the full impact of which has yet to come through) & Gold (hedge). Retail monies are lurking in the wings to follow what has, up until now, been institutional investors. Some US$7.7tn still sits in money-market funds – and investors seem content to keep it there even though yields are less (4.1%) than what they used to be (5.25% at their peak). Short duration private credit (7% to 9% yields) is the best complement for a portfolio’s fixed income exposure and another excellent hedge. The ever-growing frenzy around private credit seems to be missing the point around short-duration credit! The development and rollout of AI will benefit the wider market – both by sector and market cap and geographies. Are bulls becoming “irrationally exuberant”? Yes – if they think inflation has been licked. It’s tough to see inflation come down meaningfully from current levels….which means inflation pressure is skewed to the upside (along the lines of Trump’s first term in office). The Fed’s next/new challenge will be trying to decide how much inflation to live with while keeping rates in check. None of this will stop bond market yields drifting higher – as demonstrated by bond auctions where buyers are starting to demand higher yields. If Bond markets get the slightest whiff things are getting out of control, it will get nasty.

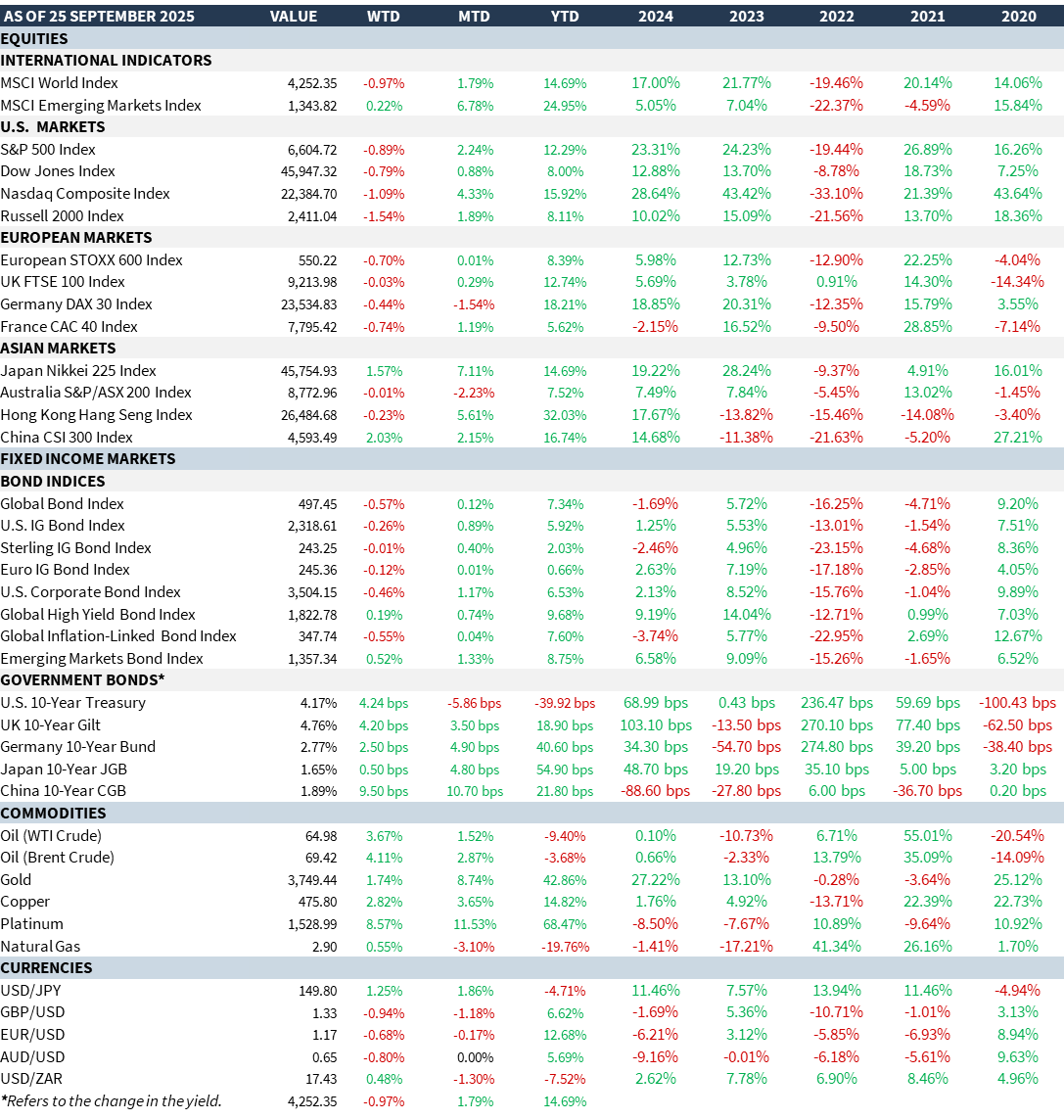

MARKET SUMMARY...