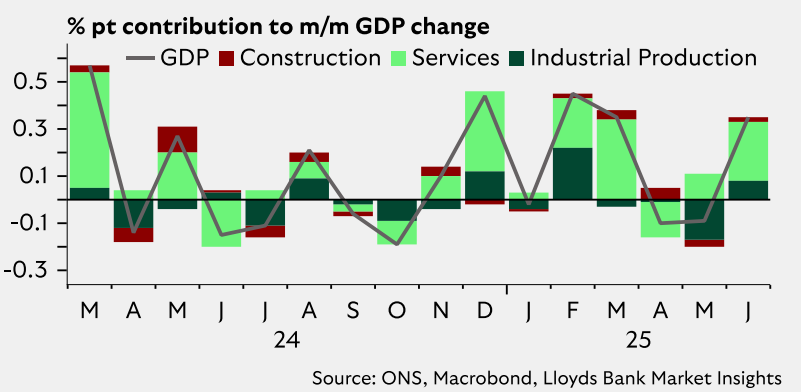

A quick update on where I left off last week in which I commented on the BoE’s very close rate cut decision. This week saw the release of the UK’s June/Q2 GDP print which surprised to the upside with a +0.3% m/m rise (vs an expected +0.1% rise). On the surface, the breakdown is shown below. The rebound was broad-based (construction, services and industrial production). It seems the warm weather has helped construction while, on the energy side of life, the decline in oil ad gas was less than expected.

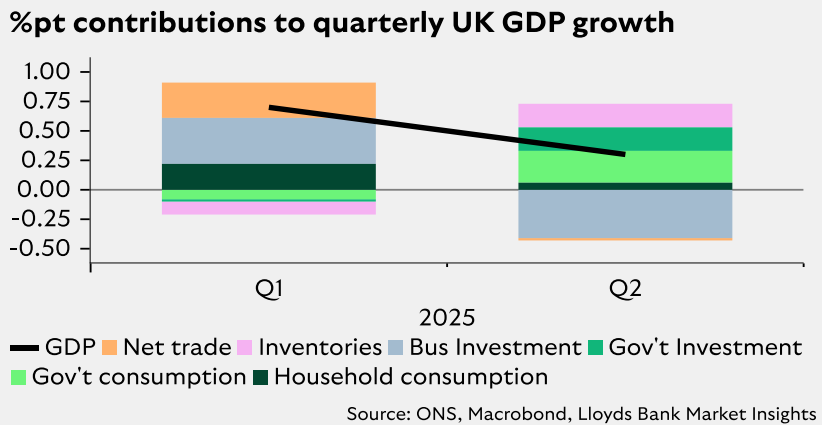

However, as with all these things, the devil is in the detail. Take a look at the more detailed breakdown in the chart below:

-

- Government consumption (aka the crowding-out effect) was the lion’s share at +1.2% q/q.

- Government investment also gave a big boost rising +6.9% q/q following a -1.7% q/q decline the previous quarter.

- The all-important household consumption (some two-thirds of the UK economy) rose just +0.1% q/q. Worth noting here that housing – which is valued at about 3.5X total UK GDP – shows a mixed picture. Mortgage lending has recovered from its lows as mortgage rates have declined. However, housebuilding remains subdued. Starts are lower vs their historical averages and residential investment is well-below the post-pandemic peaks. Expect housing to remain sluggish. No surprise the government is trying to step up planning reform as so many projects remain stalled. If this can be achieved, it gives construction a boost. The government is falling short of its housebuilding target to the tune of 300,000 pa.

- Business investment fell hard by -4% q/q reversing the +3.9% q/q of the previous quarter.

- Inventories were another boost to the Q2 GDP print – and, unless businesses are able to clear this, will end up being another headwind for the Q3 print. Judging by the weak household consumption, that doesn’t look like likely.

Markets took the data with a pinch of salt. The GB£ remains firm and odds of another -0.25% cut in rates to take the Bank Rate to 3.75% (by year-end) stands at around 66%……in other words a second cut is still viewed as happening rather than not happening. This implies the GB£ stays firm (fyi…..GS forecasts a rise in the GB£/US$ to 1.36 and 1.39 over the next 6m and 12m respectively).

Lastly, what about real (i.e. inflation-adjusted) global growth rates? With 2025 not far from closing out, consensus (Bloomberg) has the US on 1.5%, Japan on 0.8%, Euro-Area on 1.0% (France 0.6% and Spain Italy 0.5% and Spain 2.4%), UK on 1.1% and China on 4.8%. For 2026, these are a little lower with China being the more notable one at 4.2%. China aside (where disinflation/deflation persists), inflation remains the key and this impacts the inflation-adjusted GDP forecasts.

Just this week we had US inflation data – CPI and PPI. While CPI (Consumer Price Index) seems to be slowly falling and heading to target, there was a marked rise in PPI (Producer Price Index). It jumped the most in 3 years (+0.94% m/m to 3.29% y/y) supporting the case companies are passing on this increase to end users. This matters as growth is key to defining convergence or divergence in global front-ends.

The last few years has seen global front-ends move with the US curve but now, as inflation targets in G10 seem to be in sight, dispersion is arising as central banks ponder over appropriate policy. Assuming (1) there are no sudden spikes in inflation (a key risk factor as potentially posed by the jump in US PPI) and (2) no expectation of a material rise in recession risk (currently still subdued), front-end rates of G10 in general will continue to come in thus driving a steepening in the yield curve. The notable exception here has been the US because rate cuts have not been a done deal – hence the show down between Trump and Powell. However, from the last voting round, it seems Powell is being overcome….and Trump is lining up his replacement. If rate cuts accelerate, yield curve steepening will ramp up.

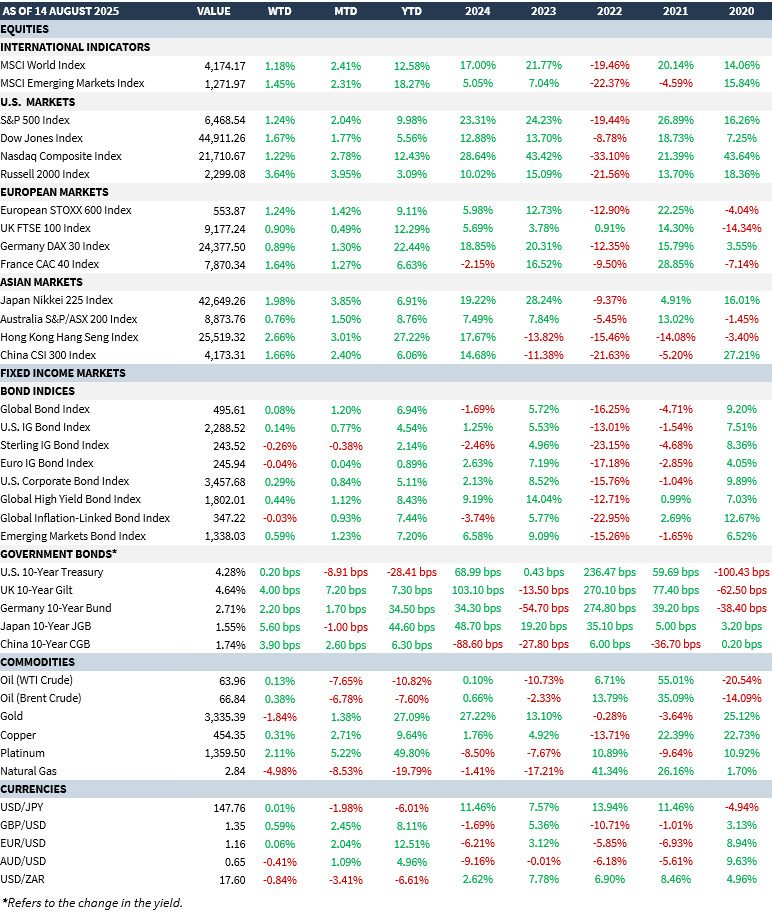

MARKET SUMMARY...