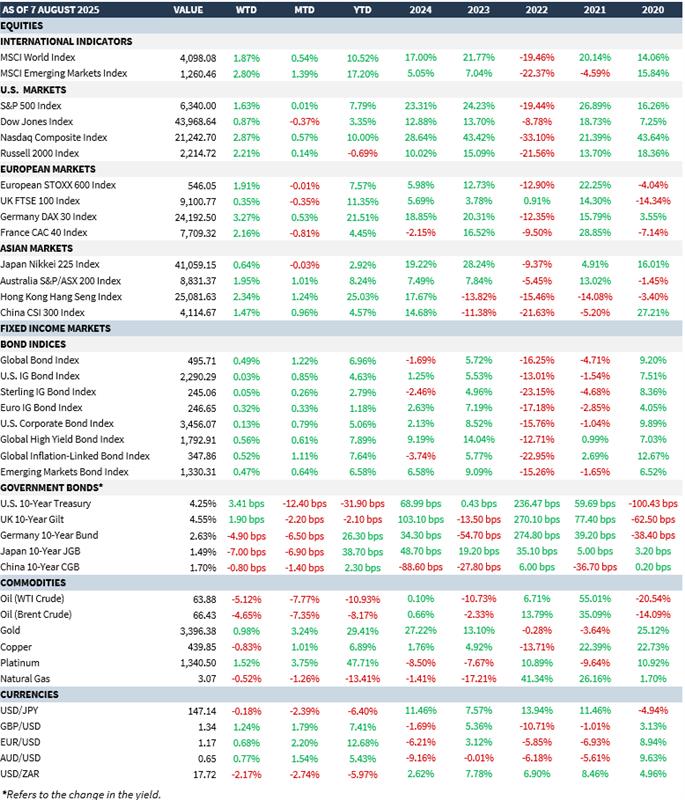

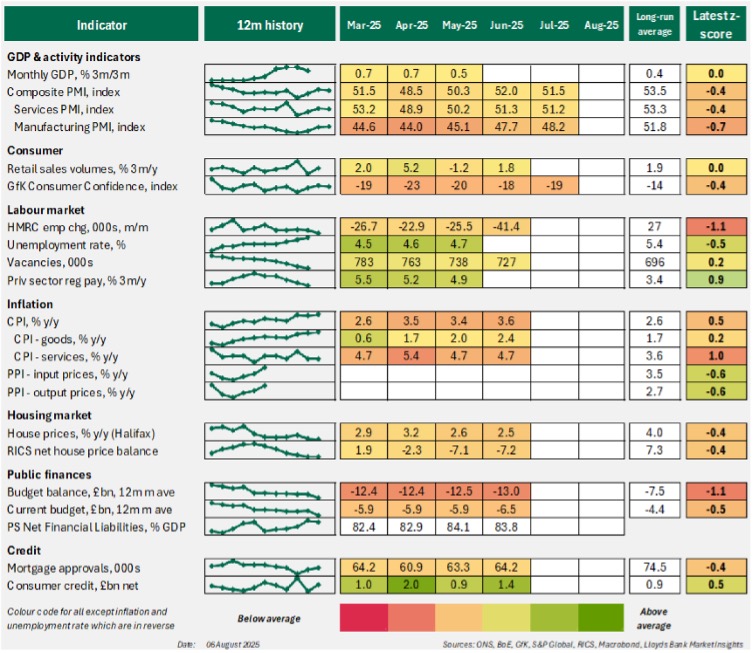

The BoE (Bank of England) cut rates -0.25% to 4.00% at its latest (7th August) meeting. Before going into the reasons, first a quick look at the economic dashboard of the UK economy:

- Services PMI (Purchasing Managers’ Index): is compiled monthly based on polling businesses. Services makes up some 80% of the country’s total economic output. A figure in excess of 50 implies expansion…..and besides April, it has been in expansion with a long-term average of 53.3. Services has been expanded form 70% in 1990 to today’s 80%. It includes retail, finance, public administration, business services, leisure and cultural activities. For London, the figure is 91%!

- Manufacturing PMI by contrast, manufacturing is between 9% to 20% (depending on measurement e.g. it can reach 23% when considering direct contribution (=9%) and wider supply chain impacts (=14%)). Manufacturing has been in contraction for some time but remains expansionary on a long-run basis.

- Retail Sales by Volume have been mixed and certainly demonstrated wild swings. Overall though, they remain in an upward trajectory and are hitting a long-run average of almost 2%. April was particularly strong helped by food store sales due to improved weather conditions.

- Employment/Earnings remains stable. Real earnings (i.e. nominal minus inflation) remains steady for both basic pay (+2.2% pa) and basic plus bonus pay (+2.1% pa). The unemployment rate has been ticking up but, overall, the labour market is not showing signs of major weakness despite the toll of rising prices. The rise in real wages has been making up for it.

- Inflation remains a challenge and shows a marked variation between goods and services. The latter is what affects the consumer the most considering the sheer weight of the services economy. If one was to measure real wages purely in terms of nominal earnings growth minus services inflation, real earnings growth would be even less – but still positive. When the latter hits breakeven, that will be a stress test for the UK consumer. The OBR (Office of Budget responsibility) forecasts a temporary rise in CPI that peaks at 3.8% for July 2025.

- House prices continue to rise, slowly but this is very much a supply-side issue. For the few homes on the market, mortgage approvals remain consistent but, again, this is misleading. Increasingly, Baby Boomers are helping to fund more recent generations with deposits. Delinquency rates show a mixed picture – the proportion of mortgages in arrears remains low overall (Q1 2025 = 2.5% vs Q4 2024 = 2%) while for BTL (Buy-To-Let) decreased from 6% over the same period. The number of homeowner mortgaged properties taken into possession in Q1 2025 increased +18% vs the previous quarter.

So, returning to the BoE rate cut decision: it was a close vote of 5 votes to 4 in favour of a cut! Have to say, I didn’t think the BoE would do it given the above comments around the economy and the lack of a truly compelling reason to cut. The Governor of the BoE, Andrew Bailey, finds himself in a similar position to Fed Chair Jay Powell over caution around inflation, jobs and tariffs in focus. However, one key difference lingers: Bailey is not living each day under the shadow of being fired. Some detail on the decision:

- It took two rounds of voting before a decision was reached. In the first round, there was no clear outcome with a result of 4-4-1. One member, Alan Taylor, backed a -0.50% cut. In the second round, it went to 5-4 in favour of a -0.25% cut. It was the first time since 1997 that the MPC (Monetary Policy Committee) held two votes.

- Chief Economist Huw Pill voted to keep rates unchanged at 4.25%.

- The four who backed keeping rates on included Clare Lombardelli and Huw Pill.

- In a press conference with reporters, Bailey said “Consumers appear to remain more cautious than we have expected, perhaps exacerbated by broader downside risks to activity and the risk of more sudden adverse developments in the labour market”. His “vote was not……motivated by…..concerns about a risk of recession” He went on to say “…..our actual view on the path of activity going forward has changed really very little since May”. When specifically asked if rates are definitely still on a downward path, he replied “Yes….I do think the path continues to be downward”. He added “Policy is still restrictive…..there is genuine uncertainty now about the course of that direction of rates….The path has become more uncertain”. He emphasised that for him the direction of that rate path has not changed (i.e. downwards) but the uncertainty is over the period of time it takes.

On the UK economy as a whole……it doesn’t look good! Immediately following the budget, the GB£ strengthened +0.6% vs the US$ to 1.3430, it has given some back. Implied yields in swap markets are giving a 70% chance of another -0.25% cut this year (vs 90% before Thursday’s decision). 2y Gilts (most sensitive to rate changes) saw yields rise +0.05% to 3.88%.The 10y is at 4.55%. All this does bring into question the new government’s growth focus and especially they way they have gone about it. In a nutshell, the UK will fare worse than the US but slightly better than the rest of Europe. Ultimately, it comes down to poor productivity. This government has pandered to workers’ pay demands very quickly thus raising employment costs (wages and National Insurance). The latter has also been worsened by tighter and more bureaucratic immigration laws, long-term unemployed and skill shortages. So, vs the rest of Europe, we will fare better only because we are coming off a low base. Vs the US, our pursuit of growth simply doesn’t compare vs the US (e.g. OBBB) – and that’s despite their fiscal deficit! Projected growth rates (though not necessarily consensus) is that that for 2025, the US will grow at around 2%, the UK at 1.5% and the Eurozone around 1%. Conveniently, 0.5% separates all three projections! My own view is that the US tends to err to the higher side, the UK too (it’s a high beta developed market play) and the EZ about right.

Speaking of fiscal deficit, Rachel Reeves (our Chancellor of the Exchequer) is looking straight down the barrel of a rather large shotgun. The NIESR (a prominent think-tank, projects a fiscal blackhole of £51bn in the public finances which means she will need to plug £41.2bn in the October budget to stay on course to meet her key fiscal target of balancing day-to-day spending with revenues by 2029/30. This projection is after taking into account recent U-turns on welfare spending. The current government has been at pains to emphasise they will stick to their manifesto pledges not to raise taxes on working people but they seem more and more confused what that means.

Granted, there are many ways to skin a cat – problem is that cat is already becoming thinner. Tax hikes – directly or indirectly – are inevitable. The only question on whom does the axe fall and how will it affect behaviour?

MARKET SUMMARY...