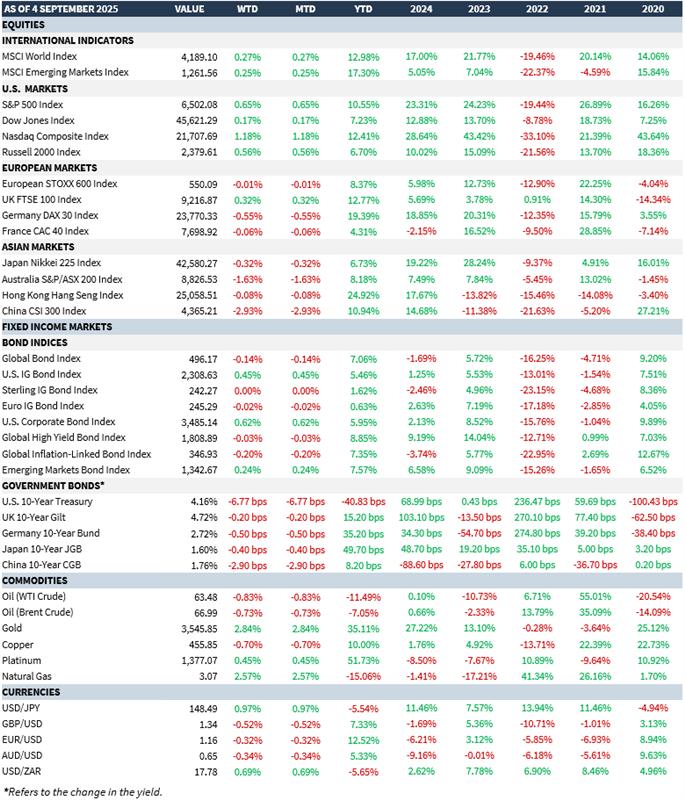

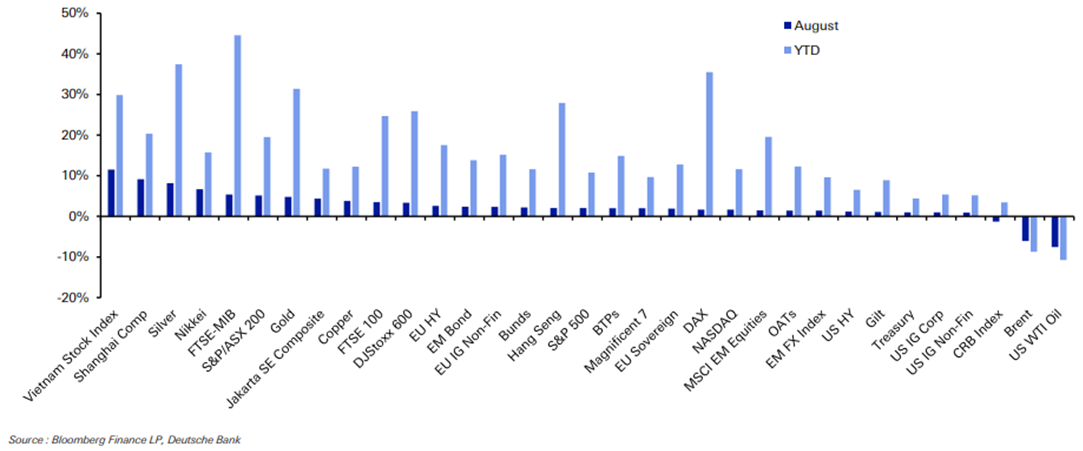

As another month ends, here’s a quick recap of August total return performance (selected assets), expressed in US$ terms:

Some highlights:

- The Vietnamese market gained over 10%….and this despite only a slight weakening in its currency of -0.54% on the month . Primary drivers were strong economic performance (GDP +7.52% in 1H 2025, the fastest 1H growth in 15 years); a trade surplus that grew to $10.18bn and an improved Manufacturing PMI reaching 52.4; good market liquidity as (1) average trading volumes on the HoSE (Ho Chi Minh Stock Exchange) hitting record highs (exceeding VND40tn and peaking at VND74.9tn on 5th Aug.) and (2) a surge by retail investors’ FOMO (over 970,000 new trading accounts opened in 1H 2025 taking the total over 10mn); the announcements of IPOs and Capital Increases; good performance from the Banking and Real Estate sectors and an alleviation in trade tensions(from 46% to 20%).

- The Shanghai Composite posted strong gains on increased liquidity from institutional and retail investors. In addition, positive sentiment was generated from government support for sectors such as AI and semiconductors as well as relaxation around home-buying restrictions in cities such as Shanghai. The rotation from lower-yielding deposits and bond yields helped drive a move from savings (showed a significant decline in household savings) to stocks. To cap it all, valuations look compelling especially on the back of improved earnings for SMEs.

- Silver received a boost from a persistent supply deficit, increasing demand from industry and a growing interest in it as a safe-haven sector.

- Japan’s Nikkei was bolstered by sharp gains for tech companies and renewed optimism over trade with the US.

- At the other end, oil prices fell even further due to (1) an impending OPEX+ supply increase (some 547,000 barrels pd) to regain market share on possible disruptions linked to Russia and (2) weakening global economic demand.

Markets were rocked in the early part of the week. The reason? On 29th August, the FCAC (Federal Circuit Appeals Court) upheld an earlier decision by the US Court of International Trade that Trump’s unilateral imposition of tariffs exceeded Presidential authority and was a decision only for Congress. Trump argued he was entitled to do so as it was being used as an emergency measure. Next stop? Very likely, the Supreme Court (SC) we could have a decision within the next 2 to 3 weeks with a fast-track, final ruling by year-end. For what it’s worth, the FCAC is democrat-leaning, the SC is Republican-leaning. Markets were spooked – and bond yields soared – because of worries tariff revenues would have to be reversed in which case, how would Trump pay for the OBBB funding?! Since then, they have calmed down especially on the back of a more subdued labour market outlook.

What continues to be a concern is the steady steepening in yield curves – especially at the long end though lately also aided by talk of rate cuts driving yields down at the short end. The principal buyers of long-dated bonds are the pension funds – and demand from them has largely faded – partly because defined benefit (DB) schemes have closed. Meanwhile, issuance hasn’t adjusted commensurately with this reduced demand resulting in an excess supply to market. The consequence? Higher yields. EZ yields have followed a similar trend. German 30y Bunds hit a 14-yr high of 3.4%. The spread (2y to 30y) in the German yield curve is actually steeper than that of the US – and this despite the German fiscal situation being in vastly better and the ECB free of any “fiscal dominance” pressures!

Speaking of the labour market, today marks the release of the all-important US, August Nonfarm Payrolls print. It was always going to be a key test following July’s weaker print. Instead, August came in at just +22,000 while the unemployment rate rose to 4.3%. Economists had been looking for a print of +75,000 job gains. Contrast this with July’s +79,000 (revised up by +6,000). Average hourly earnings rose +0.3% m/m (as expected). Hiring was held back by a reduction in Fed government hiring (-15,000). Healthcare led with a gain of +31,000. The labour force participation rate edged up to 62.3% as the labour force swelled by +436,000 hence accounting for the uptick in the unemployment rate. How does one interpret this data print?

- Technology: AI is making an impact – at least at an operational/administrative level. Just two days ago, the Salesforce CEO (Marc Benioff) confirmed 4,000 layoffs saying “….because I need less heads with AI”. He was clear that AI is doing up to 50% of the work at Salesforce. Salesforce is not alone…..HR consultants have said this is happening across several industries.

- Breakeven monthly payroll gain is changing and has been for some time as labour market dynamics revert to pre-covid days. The US has seen almost 60, consecutive months of payroll gains since 2020. However, July and August mark the largest revisions (downward) to payrolls since covid! Taken cumulatively, these revisions have been mounting since Feb-2022. Economists and analysts have not properly assessed what the breakeven, monthly payroll gain figure should be allowing for a multitude of factors that impact the labour force (e.g. immigration, age demographics, gender demographics…..in addition to technology!). More recent research (e.g. by DB) suggests the monthly, breakeven payroll could be around 50,000 allowing for the impact of immigration and deportations. So, labour market tightness is not about the dizzy heights of past, baseline payroll gains (which ran at around +100,000 per month). It’s about what you have available to work with given all the above factors!

- JOLTS (Job Openings & Labour Turnover Survey) data released earlier in the week shows one critical factor still holding steady: job layoffs. This might sound counterintuitive to what I mentioned in point 1 above but, across the nation and sectors, employees are still “job hugging” (holding on to their current positions even when they are unfulfilling) while employers are reluctant to disrupt the status quo given the costs that come with this disruption brought about by changes. Job layoffs will be a such a key indicator to keep an eye on. If it stays steady while AI keeps making inroads (like the Salesforce example above), then this translates into higher productivity…..speaking of which, August nonfarm productivity rose to 3.3% (from 2.5%) as unit labour costs were revised down to 1.0% (from 1.6%…great news for inflation). On the other hand, if job layoffs finally start to capitulate….then we have a problem! The Job Openings portions of JOLTS showed a further reduction in national openings – by itself, this doesn’t really mean much. Job Openings have been high (circa 8 million) and trickling down. Even ignoring the false portion of this (i.e. ghost jobs), these openings are AI targets.

MARKET SUMMARY...