2026 Greetings to all. Quite the start to a new year. Geopolitics has dominated with President Trump setting out his vision of the world and how to go about achieving it. In the table below I have set out the three, major map-changing events reshaping risk, power and capital flows – and how markets might respond:

| Venezuela (VZ) | Iran | Greenland (GL) | |

| What has happened | US operation removed Nicolás Maduro and ends sanctions-only containment. The US has secured preferential access and operational control over VZ oil flows (via licensing and refinery routing) for up to 50m barrels of oil. It will this through US refiners for onward market sale. US -only oil players will get to participate. No more discounted oil prices. | Escalating confrontation risk via deterrence, proxies and rhetoric; markets are pricing in Gulf disruption risk. The country has been in steady decline on all fronts – economic collapse (especially food inflation running at 70%+), social & cultural shifts (e.g. 70% of Iranians reject mandatory veiling in a society where women’s power is rising) and pessimism amongst the youth. | Trump has revived rhetoric over the acquisition of Greenland; Denmark/Greenland have rejected it; all this is testing NATO cohesiveness (all the players involved are part of NATO). |

| How this changes the geopolitical map | Confirms old-fashioned, leader removal tactics are back in play for small/mid states; reasserts US dominance in the Western Hemisphere; shrinks China / Russia influence via sanctions-evasion channels. Two oil-carrying tankers were seized while en-route to the East. It’s a replay of the 1962 blockade on Cuba under President Kennedy. | While VZ sets a precedentfor a widening in the US option-set, Iran leans further into a grey zone re tactics; “forces” a tighter alignment among anti-US blocs. | In a worse-case scenario, it exposes limits to the Alliance’s cohesion; it nudges Europe toward greater defence autonomy; Arctic hardens as a strategic denial zone vs China/Russia. |

| Likely market impact |

Oil: near-term risk premium, medium-term supply optionality caps upside. EM/LatAm: volatility in sovereign risk and licensing.Defence: mild geopolitical bid. |

Oil: carries the highest sensitivity; fast-rising risk premium on shipping/export threats. Shipping/insurance: higher costs.

Risk assets: sporadic risk-off, USD bid. |

Defence: stronger European defence-spend impulse. Critical minerals/Arctic infrastructure: optionality repricing with high execution risk. Europe risk: tail risk exists if the “NATO fracture” narrative grows. |

| Who benefits/loses? | Beneficiaries: US (leverage, Western dominance), US Gulf Coast refiners (optional heavy crude), OPEC+ (ability to manage offsets). Losers: China (debt-for-oil leverage goes), Russia (intermediary role), Maduro-era elites. | Beneficiaries: Oil producers ex-Iran (gives them price support), defence/security suppliers. Losers: Iran (sanctions pressure), Asian importers exposed to Gulf risk, shipping/insurers; no more discounting. | Beneficiaries: US intends to deny strategic access(ensuring Russia/China can’t establish a military/economic foothold in the Arctic); European defence primes itself up (the likes of Saab or Thales could be beneficiaries – perhaps too little, too late); Arctic security contractors(private firms in the fields of surveillance, logistics, infrastructure).

Losers: NATO cohesion(near-term), optics around Denmark/EU autonomy (Denmark will be seen as giving away 98% of its land mass!), Chinese Arctic ambitions (e.g. Polar Silk Road investments as Chinese companies become blocked/expelled). |

Some further points of consideration to the above:

- Venezuela: Maduro is only estimated to have 20% (30% at best) support from within. Even that is skewed to specific segments (i.e. affluent, military, middle-guys). His tenure effectively ended on 10th January 2025 but has remained by manipulating the opposition and judiciary. To describe this as a regime change is inaccurate – Maduro has been removed (to face trial in the US) but the governing party still remains albeit under a new leader (the former oil minister). However, the new regime does have to work with the US administration! The US has exploited its vast leverage facilitate this change. Maduro’s leaning to Russia and China – from the US’ own doorstep – was final straw.Overall, VZ should collect more oil revenue than before. Since 3rd Jan. (Maduro’s removal), the Caracas Stock Exchange (IBC) is +160%. On January 6 alone, the index jumped 50% in a single trading session. This surge is largely built on speculation sanctions will be lifted and multinational energy companies will return to redevelop the country’s vast oil reserves. However, the VZ market is small (some 40 listed companies), is highly volatile and the local currency (Bolívar) is plunging in parallel markets. Broader South American markets have experienced a generally positive – just less dramatic – reaction. US energy stocks (e.g. Chevron) saw an immediate uplift of +5% on 5th Jan (first day of trading).

- Iran: the Shah’s son (living in the US) has emerged as a focal point for both exiled voices abroad as well as the many chanting his name on the streets back in Iran. If Ayatollah Khamenei & and Islamic regime were overthrown and replaced by someone else, it would be a further setback for Russia and China. In one fell swoop, the Houthis, Hezbollah and Hamas would be choked off and a monumental change would follow in the Middle East. The immediate threat would be to nearby Gulf states – the old guard would try anything given the sheer size & strength of the Islamic Revolutionary Guard (IRG) and its array of weapons. Recent surveys conducted by Gamaan and Stasis reveal (conducted between 2024/25) that 70% to 80% of Iranians would vote NO to an Islamic Republic in a free referendum! Hardcore support for the current regime places it at 10% to 15% of the population. The March 2024 parliamentary elections were boycotted by 77% of eligible voters.

- Greenland: Trump wants three things: (1) most critically, gain full control over a crucial seaway for strategic purposes; (2) be able to demonstrate he has physically expanded US territorial land mass by annexing GL (optics) and (3) gain control over rare-earths and other minerals (in reality, mid-2028 is earliest date for the first commercial rare-earth production from the Tanbreez project). Trump has disproportionate leverage over GL. The US basically underwrites all of GL’s security guarantees. A nasty escalation with other NATO members would be handing Russia/China a gift……and make a mockery of everything he has just done in VZ. It’s all in the optics: he wants to control GL while Denmark can pretend they have safeguarded GL’s interests. Trump gets what he wants – and plenty more from Europe (e.g. trade and tariffs, buy more US weapons, deeper security, more bases, etc.).

MARKET SUMMARY...

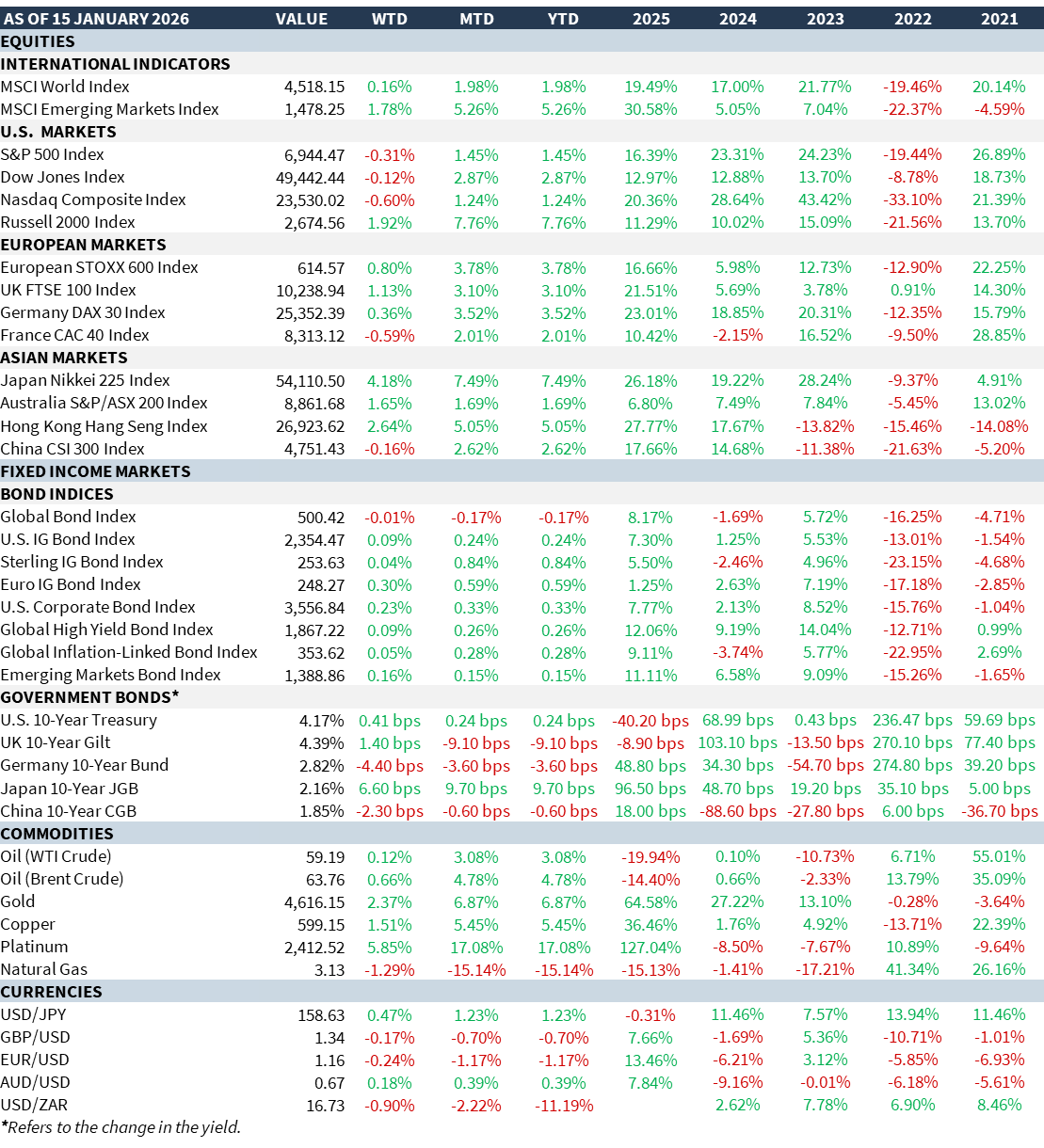

By way of markets: a very strong, risk-on start to the new year (see table below).

- Equities have rallied strongly across the board (US small caps +8%, EM +5%)

- Precious metals have continued their powerful run – Platinum +17%! Gold and Silver up too aided by the above events.

- Copper also has extended a powerful rally bursting through $13,000 per ton on the back of tighter supply and a risk-on mood. This rally has been spurred by expectations the Trump administration may introduce a tariff on the refined metal driving large volumes of copper boosting inventory in the US before any anticipated tariffs come into force. This has left a shortage elsewhere in the globe as miners are simply unable to boost output.

- FNMA was directed to buy $200bn of mortgage securities (a quasi-QE) which brought down mortgage rates (exactly what Trump wanted). Refi activity rose substantially.

- Treasuries remain range-bound (4.00% to 4.25%) as it’s all eyes on Fed Chair Powell’s replacement.

- PM Takaichi (Japan) has called a snap election to strengthen her mandate. Equities have soared (Nikkei +7.5%).