There have been quite a few developments this past week – some of which are more-than-likely going to have a material impact on markets. Here are a few of them:

- The White House shenanigans continue with the firing of CDC director, Susan Monarez, who refused to resign. A White House statement said “Susan Monarez is not aligned with the President’s agenda of Making America Healthy Again”. Her lawyer argued “she refused to rubber-stamp unscientific, reckless directives” and said only Trump could remove her. She had accused Health Secretary Robert F. Kennedy Jr of “weaponizing public health”.

- Dutch caretaker PM, Dick Schoof, survived a no-confidence vote in Parliament following disagreement over the imposition of tougher measures against Israel because of Gaza. There are 15 parties with a total of 150 seats. The biggest is Geert Wilders’ Far-Right with 37 seats….but latest polling would see this drop to 27 seats. The Centre-Right (currently 5 seats), would make strong gains rising to 24. The Greens and the People’s Party would be fairly unchanged on between 20 and 24 each. 76 seats are needed for a majority. No party wants to work with Wilders (yet!) but the fragmentation is such that it’s hard to see how the others could coalesce to form a lasting coalition.

- France is the latest to see political crisis resurface. PM Bayrou (the 6th PM under President Macron) has called a vote of (no) confidence on 8th September hoping it will “browbeat” the opposition into passing the budget. The latter is looking to cut spending (see point 4). It’s a very close one – either he woos the Far-Right or he’s hoping for LeftistMPs to abstain.

- France’s debt is spiralling – but it’s not alone. Look at the UK and the pressure Reeves is under! Spain is in the throes of a corruption scandal, Poland saw a nationalist take the Presidency and Germany’s new coalition seems to be going nowhere. You know things are bad when Italy is perceived as looking stable!

- Meanwhile, the EU is seeking to fast-track legislation to remove all tariffs on US industrial goods thus meeting yet another one of Trump’s demands. Officials conceded: “the US is getting the better bargain”. So why accept it? The EU argues it’s not just about trade but also security (including the Ukraine situation and energy supplies). The EU (incl. UK) remains highly dependent on the US for its security, especially defence, due to years of under investment. The fear is that these tariffs will spur European companies into building factories in the US and thus move away from Europe. This is exactly what Trump wants.

- The EU is said to be mulling secondary sanctions against those nations helping Russia circumvent restrictions. The mechanism was adopted in 2023 and would allow the EU to restrict exports, supplies or transfers of certain goods to nations believed to be aiding Russia in evading sanctions. It’s debateable how effective this would be following the recent Trump-Putin summit. Prior to that, it would have been a blow to Russia but the summit now gives Russia a backdoor. Furthermore, how much more strain does this put on an-already exposed EU?

- Mexico is planning to increase tariffs on China as part of its 2026 budget. This was another Trump-led demand. The draft proposal goes to Mexico’s Congress between now and 8thSept. It’s likely to go through as the budget will require approval from the legislative branch where Mexico’s President (Claudia Sheinbaum) and her allies hold a two-thirds majority. The end objective is to limit cheap imports from China while strengthening the USMCA (US-Mexico-Canada) alliance. Mexico’s top imports are cars ($3.3bn) and car parts ($2.6bn). Then it’s smartphones and flat panel displays ($2.2bn and $2.0bn respectively). The US and Mexico are also closing in on a deal to combat drug trafficking and violence. It’s because of the latter that Mexico is currently paying a 25% tariff on items not covered under the USMCA agreement. Presumably, this (or at least most of it) goes away ifMexico’s government passes tariffs on China. At the very least, it will make remaining negotiations easier.

Three of particular interest to me:

Trump firing Fed Reserve Governor Lisa Cook (a Biden appointee) for alleged mortgage fraud. Cook has made it clear she won’t resign – in fact, she confirmed she will sue Trump over his move to oust her from the Fed Board. Markets have been blasé – the 30y US Treasury yield rose just 0.05% (or 5 bps). Trump’s desire to see interest rates lowered – almost on an Erdogan-wide scale – is well-documented…..but to accomplish this, he needs to exert fiscal dominance on the Fed. He can’t do this directly or else the Fed’s perceived independence goes straight out of the window and market mayhem will ensue. So, just like with the Supreme Court (SC), he needs enough members on his side to “ensure” allegiance.

By removing Lisa Cook, it paves the way for a new member to be brought on who, of course, would be Trump-leaning. Lisa Cook’s actions buys Powell some time as it challenges Trump’s ability to remove her – or any other Fed Board member – from their position. Cook’s term doesn’t officially end until 2038. The case now goes to US District Judge Jia Cobb, a Biden appointee. The irony is what if this should ever go to the Supreme Court !? Don’t forget, back in May, the SC cleared the way for Trump to oust officials at two other government agencies without having to give justification. However, they also went on to say this doesn’t mean the President wielded similar authority at the Fed!

Regardless, it is clear Trump wants to effect quasi control over the Fed for the purposes of rate cuts – and suggestions are they will go over and above what is needed to reach the neutral rate. A Fed effectively under presidential control would mean lower short-dated yields but higher long-dated yields. The short end is yielding between 3.6% and 4%. The long end is yielding 4.90%. The latter determines interest-servicing costs. His game plan is lower rates + lower energy costs = higher growth. That’s achievable in the short term…..but it stokes inflation. If the long end starts settling comfortably above 5%, it will take some effort to bring it back under control.

Nvidia reported Q2 earnings and revenue on Wednesday this week. Some highlights:

- Both were better than expected (Earnings: $1.05 actual vs $1.01 expected; Revenues: $46.74bn actual vs $46.06bn expected). These numbers are despite there being no sales of H20 processors to China-based customers (only a $180m sale to a client outside of China).

- It said Q3 revenue guidance is $54bn (+/-2%) and assumes no H2O shipments to China (vs analyst forecast of $53.1bn).

- The stock price fell heavily in extended trading because data centre revenue came in short on expectations. The company remains entrenched in its global AI buildout with some $3tn to $4tn of AI infrastructure spending by the end of the decade.

- Revenues are +56% y/y and has exceeded 50% y/y for nine, successive quarters. A key point is that the processor (the H2O) was custom-built for China and because it didn’t sell any to China, it cost $4.5bn in write downs. Otherwise, it could have added $8bn to Q2 sales if it has been commercially available. In a meeting with Trump, CEO Huang is expecting to get licenses to ship the H2O to China. Net income rose +59% y/y.

- It’s sale of Blackwell chips (its most advanced) were up +17% q/q to $27bn, accounting for about 70% of data centre revenue. Its gaming division was +49% y/y while its robotics division (smaller) was up +69% y/y.

- Two (unnamed) clients account for some 40% of its sales. The company is not obligated to disclose their names in its filings – only their concentrations. Rumours (by Industry analysts & media) point to companies heavily investing in AI infrastructure (e.g. Amazon, Google, Meta, Microsoft, foreign governments and Neoclouds). Top suspects are Amazon and Microsoft (AWS and Azure respectively), especially for the neocloud component.

These days, a US CEO’s survival demands Political skill, not just commercial skill, when steering a company. This earnings release was much more about what Nvidia was not permitted to do (i.e. sale of its H2O chips to China). The share price drop was attributed to a slight drop in the sale of its GPUs (Graphics Processor Units). Despite rising 56% y/y to $41.1bn, analysts had expected $41.34bn! If anything, this was a rather knee-jerk reaction, a case of glass half empty rather than half full. It ignores the guidance the company is giving. As for the “AI trade” in general, we’re still seeing heavy investment in infrastructure. Its share price action will also be heavily affected – as indeed the rest of the tech players – by what happens at the Fed and rate cuts.

Last, China is growing its exports to Africa at an alarming rate in its efforts to make up for lost US trade revenue. Export growth to the US has fallen -$25.7bn in 1H 2025. This equates to a -34% decline in the past quarter vs the same quarter last year. Against this however, ASEAN has risen $37.1bn (+13%), EU has risen $16.3bn (+6.9%), LATAM has risen $7.3bn (+7.3%)……and Africa has risen $18.2bn (+21.4%). The biggest targets are Nigeria (11%), South Africa (10%) & Egypt (9%) and construction machinery (+63% YTD) was the fastest growing of exports as China breaks into Africa’s infrastructure market. Exports to South Korea and Russia both declined -$2.5bn and -$8.7bn (-2.5% and -8.7% respectively).

In an increasingly isolationist/protectionist world, China needs to get its household consumption portion of GDP higher. Currently, it sits at 39.6% (World Bank). Contrast this with the global average of 56%. In defining a “developed nation”, the reliance on household consumption is key. It needs to boost household consumption from 40% (now) to at least 50% over the next 5y to 10y. Fyi, the US stands at 70%, the EU at just over 50% and Japan at 56%. It comes down to income per capita (not just income but pensions too i.e. an overhaul of the welfare system). So stabilising the trade account is a key first step in ensuring it can focus on the consumption side of the economy.

There’s no doubt Trump is trying to torpedo these efforts. What will be interesting going forward is to what extent these other non-US regions will continue to absorb this. Africa aside, both the EU and ASEAN are also manufacturing hubs…..just not on the same scale. How long before they also try and replicate what Trump is doing i.e. bring it home. This is why the US has the “luxury” of playing tariff wars with the RoW in the short term. In the long term, they don’t want to be dependent on anyone else for goods while China wants to rely on its own household consumption!

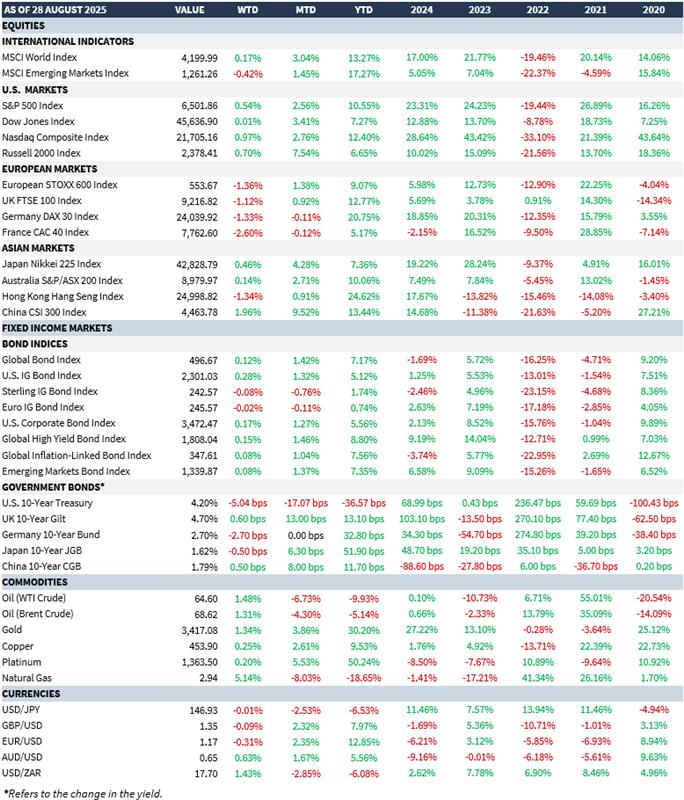

MARKET SUMMARY...