Tariff volatility kicks off again!

Just when the dust seemed to be settling on the tariff front with some big deals having been secured, this morning (Friday) sees the announcement of some new tariffs by Trump:

1 – Last weekend saw the US and EU conclude a . It puts a tariff of roughly 15% (down substantially from 30% and the 50% that had been touted previously) on most EU products entering the US (including autos, pharma and semiconductors) while also eliminating EU tariffs on US products. The speed with which this deal was announced is very telling. Only a few days before, the US concluded a deal with Japan. Tariff latest:

2 – While there will be an increase in most US tariffs on incoming EU goods, some would also fall to zero (e.g. aircraft and parts, certain chemicals, certain generic drugs, semiconductor manufacturing equipment, certain agricultural products, natural resources and critical raw materials). On steel and aluminium, tariffs would be cut but quotas would be implemented.

3 – The EU looks set to eliminate tariffs on US goods – but it’s not large as it was only around 1%.

4 – Taking this and last week’s Japan deal implies the overall US Effective Tariff Rate (ETR) is reduced by about 0.3% bringing it close to 15%. Should a further 15% tariff be applied across-the board on autos for all trading partners, the ETR would fall a further 0.5%.

5 – As with Japan, the US has secured purchase commitments for US products of $750bn in energy (over 3 years vs the $80bn pa currently) as well as an investment pledge of $600bn.

6 – South Korea has also struck a deal reaching a blanket tariff rate of 15% on its exports. Duties on its auto exports are reduced to 15% as well. SK “will give $350bn for investments owned and controlled by the US and selected by myself as President” said Trump! SK President Myung put forward a somewhat different perspective saying it would play a role in facilitating the active entry of Korean firms into the US in industries such as shipbuilding and semiconductors.

7 – In Trump’s first term, tariffs imposed were valued at roughly $380bn (2018 and 2019) and affected approximately 15% of US goods imported. This time round, the tariff impact is on most imports (71% or $2.3tn-worth) with only a few exceptions (e.g. USMCA trade valued at $405bn and certain energy-related & other valued at $644bn).

8 – Today, Trump signed an Exec. Order modifying reciprocal tariffs on numerous countries with updated duties ranging from 10% to 41%. The new rates start from 7th August. Trump emphasised it is not an extension – it gives US Customs & Border control time to adapt and prepare. The door is still left open for negotiation but the onus is now on these countries. He has also followed through on plans to raise tariffs on exports from Canada to 35% (from 25%) from today (excluding those covered under the USMCA pact).

He also suggested (not definite!) raising the baseline tariff to between 15% and 20% on imports from countries that have not negotiated separate trade agreements – leading Asian markets to drop. Chinese exports face a tariff deadline of 12th August and are currently unaffected but these announcements. However, while discussions are ongoing, of primary concern to the Chinese will be the 40% transshipment tariff which was previously applicable to Vietnam but is now extended beyond.

US GDP was released for Q2 2025 and grew 3.0% (y/y or annualised rate) in real terms. Contrast this with Q1’s -0.5% y/y decline. A breakdown shows:

- There was a huge drop in imports. The latter detracts from GDP and in Q1 buyers front-loaded import buying to dodge tariffs. In Q2, businesses and consumers reduced stockpiles explaining why there was a sizeable drop in inventories (also a detractor from GDP data). Following a +23.8% spike in Q1, inventory plummeted -15.6% in Q2.

- Consumer spending (70% of GDP) rose at a faster pace helped by spending on goods. Overall, the pace was still the slowest in consecutive quarters since Covid. The services component rose +1.1%, durable goods (anything whose expected lifetime is greater than 3 years) gained +3.7% and non-durable goods rose +1.3%. Overall, a still a solid performance for what is the most important part of GDP.

- Fixed Investment (about 18% of GDP) slowed. While non-residential investment rose +1.9%, within that the structures component fell -10.3%. Residential investment fell -4.6% as a property overhang develops.

- Government spending (about 10% of GDP) rose +0.4% helped by defence (+2.2%) even though non-defence fell heavily.

- State & Local Government spending (17% of GDP) rose +3.0%.

Stripping out components such as trade, government consumption and investment and inventories, you are left with the closest measure of the private economy. It equates to 87% of US GDP. In Q2, that rose +1.2% y/y (=$20.7tn).

For this reason – and in an attempt to protect this measure – you can see why Trump is getting angsty with Powell. The latest FOMC statement was important: as expected, by 9 votes to 2, the Fed left rates unchanged (between 4.25% to 4.50%). Two Governors voted for a rate cut (Bowman and Waller) and their opposition marks the first time since 1993 that two members dissented from the majority.

In a Press statement afterwards, Powell emphasised policymakers will wait to make sure tariffs don’t turn into “serious inflation”. Perhaps today’s July nonfarm payrolls might give him a nudge. 73,000 jobs were added but, significantly, there were sharp, downward revisions to May (from 144,000 to 19,000) and June (from 147,000 to 14,000)! Taken together (May, June & July), it’s a weak report. Worth noting though that there is a marked difference between the nonfarm print vs the ADP number (private sector only). The latter added 104,000 in July. A review of June’s JOLTS (Job Openings and Labour Turnover Survey) release shows nothing of any major concern.

Critically, the layoffs/discharges rate remains low and steady while the quits (voluntary) rate remain healthy. In other words, the wider economic picture is not showing any major cracks – while the tariff saga and weaker jobs report is fuelling volatility!

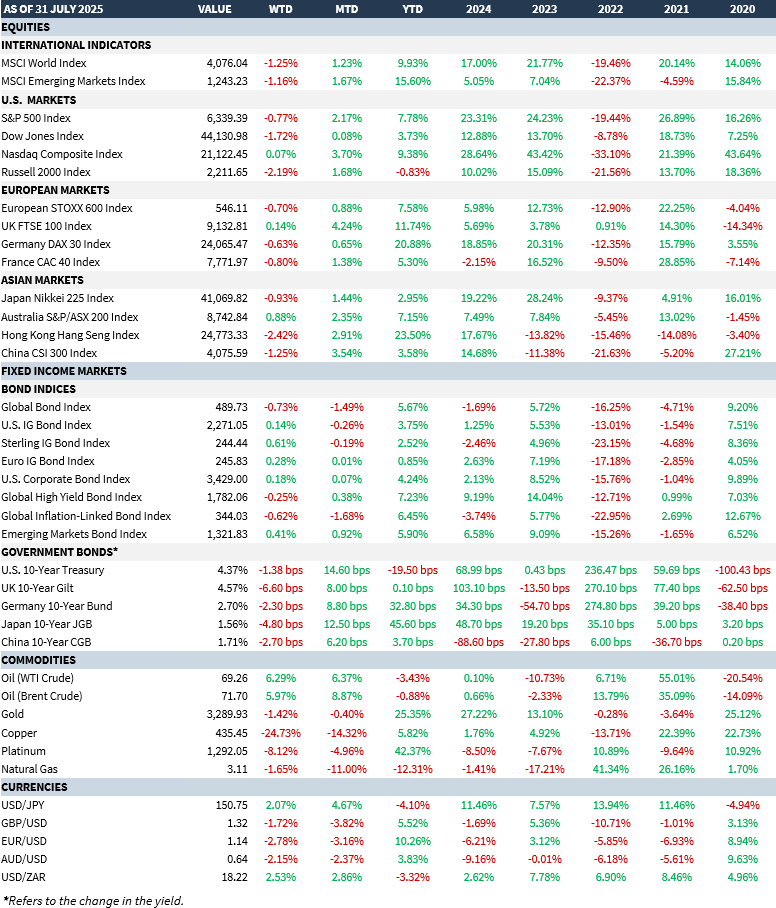

MARKET SUMMARY…

The biggest shock – which took place yesterday (in fact it was overnight Tuesday) – was the sharp crash in copper prices! While Trump had set a 50% tariff on copper back in early July, yesterday he announced that while this still stands, he would be exempting refined metals (which are the mainstay of international trading). Copper futures in NY fell over -22%. Prices fell in London (LME) too – just nothing like as much (-0.6%).

Will all this result in continued volatility?

Unlikely – we should see a return to normal flows. Nevertheless, short sellers have had a field day.

Why did this happen?

Key players in the copper space have argued there simply wasn’t enough capacity to replace all copper imports that quickly! This new ruling applies to pipes, wires, rods, sheets, tubes, connectors, electrical components…..and much more. Additionally, the Commerce Department has recommended a staggered and delayed imposition of the 50% tariff on the rest of the copper sector. In response, Trump has requested the department provide an update on US copper by end of June 2026.

Over the month, other notable – but not so drastic – moves were:

- The US$ gained +3.2% on the month (best performance since April 2022); it is still down -7.85% YTD.

- The US Tech story bounced back with the NASDAQ rising +3.7% on the month.

- Oil gained +7.3% on positive growth prospects and concerns over Russian supplies.

- Crypto did well – BTC gained +8.26% peaking at $123K before pulling back. New US Congressional legislation (including the GENIUS Act) formalised stablecoins.

- The YEN fell heavily vs the US$ (-4.7%) as concerns mount the BoJ is being slow to deliver rate hikes and government fiscal policy.

- Brazil and India saw equity markets hit hard over new, higher tariffs.

- It wasn’t good for Sovereign bonds – UK Gilts were hit hard (-4.2% in US$ terms) as the UK government did a U-turn on welfare spending.