alternative assets industry

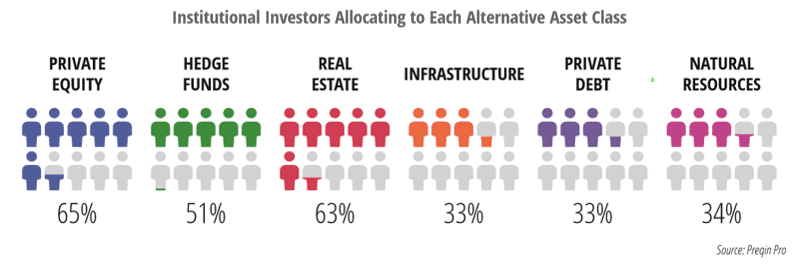

In June 2019, there were over 15 000 institutional investors active in the alternative assets industry. Among alternative assets, private equity was the most popular asset class in terms of allocations, followed by real estate and hedge funds. Private debt and infrastructure were the least common classes allocated to.

As of June 2019, 74% of investors believe equity markets are at a peak, up from 56% in the year prior, while only 6% think we are in an expansion phase. Many believe that a correction will come in the next 12-24 months.

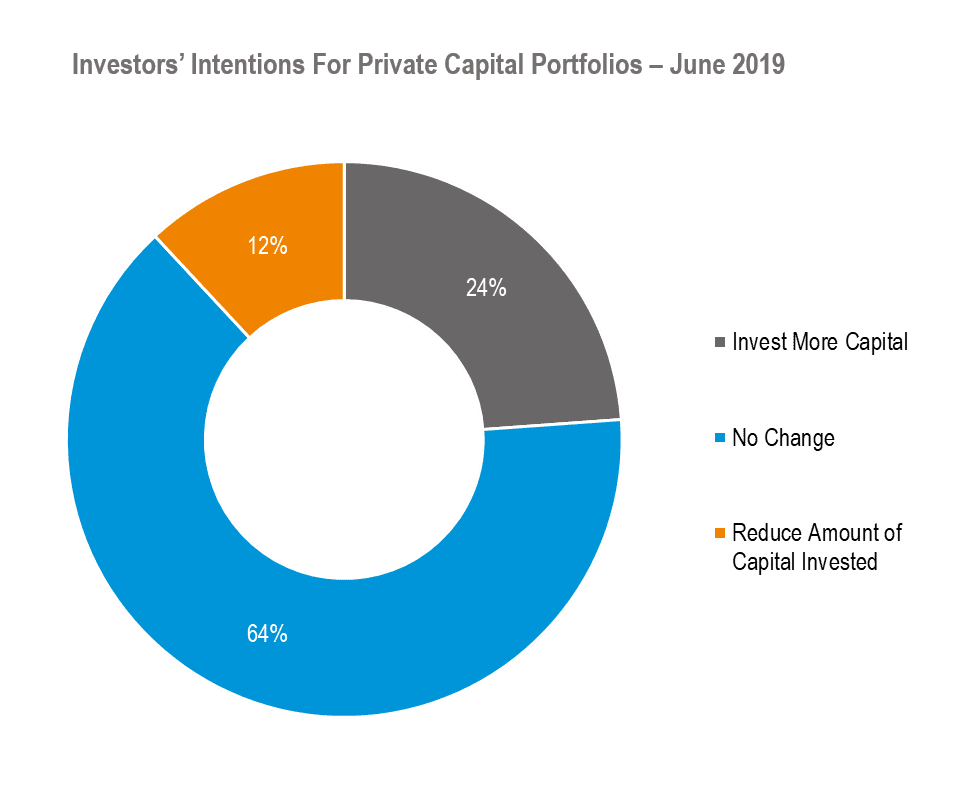

Despite widespread caution regarding the market cycle, more investors in 2019 intend to increase, rather than decrease, exposure to alternative investments.

This strategy seems to be logical, based on the following evidence:

- It is challenging to time the market, especially in illiquid assets

- Alternatives faired relatively well during the Global Financial Crisis

- Defensive/uncorrelated nature of some alternatives

Preqin expects Alternatives AUM to reach $14 trillion by 2023.

Private Credit Funds

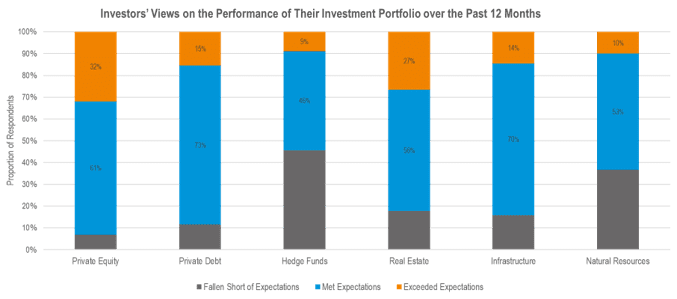

Investors are largely satisfied with the performance of their Private Debt portfolios over the past 12 months, with 73% of investors saying performance met their expectations and 15% of investors saying performance exceeded their expectations.

In addition, 39% of investors expect capital commitments to Private Debt to increase in the next 12 months, while only 12% expect it to decrease.

Within Private Debt, 2019 has been a strong year for direct lending, with 65% of aggregate capital raised being for direct lending funds YTD. Other fund types include special situations (15%), distressed debt (13%), mezzanine (4%), direct lending (2%), and private debt fund of funds (1%).

Private Equity

There is a massive base of unrealised assets in Private Equity Buyout Funds, $897 billion across 2 392 Buyout funds in Europe and North America.

Private equity AUM continues to grow strongly, increasing primarily in North America, Europe and Asia.

Fund Finance Market

Preqin believes that global lender commitments increased by 15-20% in 2018, materially exceeding their estimates for the year. They now estimate the global market at $525 billion.

Key Takeaways

- Alternative Assets continue to exhibit strong growth and are likely to continue to perform in the face of market cycles, supported by return profiles and investor motivations.

- There is a growing need for liquidity solutions for GPs and LPs.

- Private credit funds offering attractive risk-return profiles are and will continue to grow strongly.

References

Preqin; Private Equity and Credit Opportunities. October 2019.